Rahul Bajaj was born on 10th June 1938 at Bengal Residency, British India. He is an Indian businessman, industrialist, politician, Forbes billionaire and a member of the Indian Parliament. In 2010, Forbes had estimated his net worth to be US $ 1.1 Billion making him one of India’s Top 50 richest persons. He is the Chairman of Bajaj Auto, a leading Indian Automobile Manufacturer.

Family:

Rahul Bajaj is a son of Rajasthani Businessman Jamnalal Bajaj who started Bajaj Auto in 1945. He has one brother, Shishir Bajaj, with whom there was a recent business settlement ending the family dispute. He has 3 cousins, Shekhar, Madhur and Niraj together with whom he controls the Bajaj Group of companies. He is married to Ruparani and has two sons Rajiv & Sanjiv who are involved in the management of his companies and a daughter, Sunaina Kejriwal who is married to Manish Kejriwal who heads Temasek India.

Growing up:

Rahul Bajaj went to The Cathedral and John Connon School. He graduated from St. Stephen's College in Delhi in 1958 with an honors degree in economics. He underwent on-the-job training for 4 years at two of the group companies. During that time, he also earned a law degree in Bombay. He is also an alumnus of the prestigious Harvard Business School in USA.

Bajaj Auto:

The US$ 1.32 Billion worth Bajaj Auto is the main flagship company of the Bajaj Group which employs over 20,000 people with a turnover of over US $ 3.20 billion.

Today, with revenues of $1.5 billion and a market capitalization of $3 billion, the company sells nearly 2 million vehicles per year in India and other developing countries in Africa, Latin America, and Southeast Asia.

Constant changes in employee management and training led to reduced costs and improved quality. For example; it took 22,000 workers to produce 1 million vehicles in 2000, but only half of that number to make 1.8 million vehicles four years later.

In addition, Bajaj Auto has consistently invested in R&D which made the company capable to develop products desired by the customer at a low cost. This has been an important source of confidence for the future.

Awards:

For its performance, Bajaj Auto has received various awards including:

The 1977 Export Award from the Federation of Indian Chambers of Commerce and Industry (FICCI).

The 1985 Economic Times & Harvard Business School Association Award for Corporate Performance.

CII Award for Quality and Reliability in 1984 & 1988 and for Technology and Innovation in 1985

For 1994-95 Bajaj Auto received the Engineering Export Promotion Council’s award for the highest exports of consumer durables nationally and the highest exports of engineering goods in the Western Region.

Bajaj Auto received Dalal Street Journal's Corporate Excellence Award for 1990 & 1995.

Rajeev Suri ( born 1967) is the chief executive officer of Nokia. Before the current assignment in May 2014, he was the CEO of Nokia Solutions and Networks since 2009 and held various positions in Nokia since 1995. Suri became the CEO of Nokia when the sale of Nokia's phone division to Microsoft Mobile was completed. He has a Bachelor of Engineering from Manipal Institute of Technology and worked for multinational corporations in India and Nigeria, before joining Nokia.

Early life:

Rajeev Suri was born in New Delhi in 1967 to parents Yashpal and Asha. Suri's father was from the Punjab region but in 1958 his parents had moved from India to Kuwait, where his entrepreneur father had a car imports business and where Suri was raised until 1985. He spoke Hindi at home, went to Indian Community School, Kuwait and learned to read and write Arabic.

Suri studied Electronics and Communications Engineering in the Manipal Institute of Technology, India (class of 1989).

Career:

Before joining the Nokia group, Suri had worked for Calcom Electronics and ICL in India as well as for Churchgate Group in Nigeria.

In 1995, Suri joined the Nokia group. Suri was instrumental in driving the Nokia Siemens Networks’ Services business unit's revenue in the company to grow from less than a third to about half.Suri motivated the company to create a new Services hub in India. Before heading Services, Suri headed the Asia Pacific operations from April 2007 until November 2007. From 1995 to March 2007, Suri worked on a number of assignments at Nokia Networks in Business Development, Marketing, Sales, Strategy from India, Finland, the United Kingdom and Singapore.

Suri followed Simon Beresford-Wylie as the CEO of NSN in October 2009 after Nokia Networks and Siemens Networks had been merged. He is considered a 'turnaround specialist' in the global tech circles.

On November 23, 2011, Suri announced that the company planned to eliminate 17,000 jobs by the end of 2013 to enable NSN to refocus on mobile broadband equipment, the fastest-growing segment of the market. The reductions would slash the company’s work force by 23 percent from 74,000. The cuts followed NSN’s $1.2 billion purchase of Motorola’s mobile network equipment business in July 2010, which added staff; and would help the company trim annual operating expenses by $1.35 billion by the end of 2013.

On 29 April 2014, Suri was appointed as the CEO of Nokia. This was after Nokia had bought back full control of NSN and sold Nokia's phone division to Microsoft Mobile.

Suri is one of those rare top corporate executives who have achieved heights without pursuing any MBA/PG degree.

Personal life:

Suri is based in Espoo, Finland, Nokia headquarters. His wife Nina Alag Suri is the founder and CEO of the executive search business Nastrac Group. His younger son Anish (18 years) is based in Singapore but now studies business at The University of Edinburgh. His elder son Ankit (22 years) is studying music composition in Boston at Berklee College of Music. He has lived in 7 countries including India, Kuwait, Finland, UK, Nigeria, Germany and Singapore.

Suri is a fitness enthusiast. He is an avid music lover.

Rajnikant Shamalji Ajmera 'Rajnikant Ajmera’ (born 3 March 1953) is an industrialist based in Mumbai. He currently heads the US$ 450 million worth Ajmera Group having interests in realty, construction and related businesses.

He was born to late Shamlaji Ajmera and has many siblings, who are partners in Ajmera group. Apart from Ajmera group he is also heads the Shree Percoated Steels Limited. He was elected as the President of CREDAI (Confederation of Real Estate Developers Association of India), the apex body of real estate developers across India in April 2007 and also has been the President of Maharashtra Chamber of Housing Industry (MCHI).

Ajmera group was also in news when they jointly with Bakeri group purchased Ahmedabad's prestigious Calico Mill's property at government auction for Rs. 350 crores in 2010.

He also heads his family's charitable trusts and is trustee in several trusts belonging to BAPS Swaminarayan Sampraday. He is diploma holder in civil engineering.

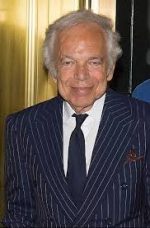

Ralph Lauren ( born ; October 1, 1939) is an American fashion designer, philanthropist, and business executive, best known for the Ralph Lauren Corporation clothing company, a global multi-billion-dollar enterprise. He has also become well known for his collection of rare automobiles, some of which have been displayed in museum exhibits. Lauren stepped down as Chief Executive Officer of the company in September 2015 but remains its Executive Chairman and Chief Creative Officer. As of January 2015, Forbes estimates his wealth at $8 billion, which makes Ralph Lauren the 155th richest person in the world.

Career:

He went to Baruch College where he studied business, although he dropped out after two years. From 1962 to 1964 he served in the United States Army and left to work briefly for Brooks Brothers as a sales assistant before leaving to become a salesman for a tie company. In 1966, when he was 26, he was inspired to design a wide, European-style necktie he had seen Douglas Fairbanks, Jr. wearing, but the idea was rejected by the company for which he worked as not being commercially viable. He left to establish his own company, working out of a drawer in the Empire State Building, taking rags and turning them into ties. He sold the ties to small shops in New York, with a major turning point when he was approached by Neiman Marcus, who bought 1,200.

In 1967, with the financial backing of Manhattan clothing manufacturer Norman Hilton, Lauren opened a necktie store where he also sold ties of his own design, under the label "Polo". He later received the rights to use the trademark Polo from Brooks Brothers; however, Brooks Brothers managed to retain its rights to the iconic "original polo button-down collar" shirt (still produced today), in spite of Lauren's Polo trademark. In 1971, he expanded his line and opened a Polo boutique on Rodeo Drive in Beverly Hills, California.

In 1970, Ralph Lauren won the Coty Award for his menswear line. Around that same time he released a line of women's suits that were tailored in a classic men's style. This was the first time the Polo emblem was seen, displayed on the cuff of the suit. Ralph Lauren released Polo's famous short sleeve pique shirt with the Polo logo in 1972 and unveiled his first Ralph Lauren collection for women.It came out in 24 colors and soon became a classic.He also gained recognition for his design after he was contracted to provide clothing styles for the movie The Great Gatsby as well as for Diane Keaton's title character in the 1977 feature film Annie Hall.

In 1984, he transformed the Gertrude Rhinelander Waldo House, former home of the photographer Edgar de Evia and Robert Denning, into the flagship store for Polo Ralph Lauren. This same year de Evia photographed the cover feature story for House & Garden on the Lauren home Round Hill in Jamaica,which had formerly been the home of Babe and Bill Paley.On June 11, 1997, Ralph Lauren Corporation became a public company, traded on the New York Stock Exchange under the symbol RL.

By 2007 Ralph Lauren had over 35 boutiques in the United States; 23 locations carried the Ralph Lauren Purple Label, including Atlanta, Beverly Hills, Boston, Charlotte, Washington, D.C., Chicago, Costa Mesa, Dallas, Denver, Honolulu, Houston, Las Vegas, Manhasset, New York, Palm Beach, Palo Alto, Philadelphia, Phoenix, San Diego, Short Hills, Montreal and Troy. The Financial Times reported in January 2010 that the firm had revenues of $5 billion for fiscal year 2009.

On September 29, 2015, Ralph Lauren announced that he would be stepping down as Chief Executive, to be replaced by Stefan Larsson, the President of Gap's Old Navy chain.

Awards and honors:

In 2010, Lauren was declared Chevalier de la Legion d'honneur by French President Nicolas Sarkozy in Paris.

In 2014, Lauren was awarded the James Smithson Bicentennial Medal.

Ratan Naval Tata GBE(born 28 December 1937) is an Indian businessman, investor, philanthropist and chairman emeritus of Tata Sons. He was the chairman of Tata Group, a Mumbai-based global business conglomerate from 1991 till December 28, 2012 and continues to head its charitable trusts. He was also chairman of the major Tata companies, including Tata Motors, Tata Steel, Tata Consultancy Services, Tata Power, Tata Global Beverages, Tata Chemicals, Indian Hotels and Tata Teleservices. During his tenure, the group’s revenues grew manifold, totaling over $100 billion in 2011-12.

Mr. Tata is also associated with various organizations in India and overseas. He is the chairman of two of the largest private-sector-promoted philanthropic trusts in India. He is a member of the Indian Prime Minister’s Council on Trade and Industry. He is the president of the Court of the Indian Institute of Science and chairman of the Council of Management of the Tata Institute of Fundamental Research. He also serves on the board of trustees of Cornell University and the University of Southern California. Mr. Tata serves on the board of directors of Alcoa, and is also on the international advisory boards of Mitsubishi Corporation, JP Morgan Chase, Rolls-Royce, Temasek Holdings and the Monetary Authority of Singapore.

B. Ravi Pillai (born 2 September 1953) is an Indian entrepreneur and the head of RP Group of companies. A recipient of the 2008 Pravasi Bharatiya Samman,Pillai was honored again by the Government of India, in 2010, with the fourth highest Indian civilian award of Padma Shri.

Career:

During his time at Cochin University, he launched his first business, a chit fund in Kollam on reportedly borrowed money. Later, he started engineering contract business and worked for some of the major industrial houses in Kerala such as Fertilisers and Chemicals Travancore Limited, Hindustan Newsprint Limited, and Cochin Refineries. However, a labour strike forced him to close down his business after which he went to Saudi Arabia in 1978 where he started a small trading business. Two years later, he moved to construction business and established Nasser Al Hajri Corporation with 150 employees, which has over the years grown to become the flagship company of his business group, R. P Group, which is known to employ over 70,000 employees across its businesses.The shopping mall in South Kerala, RP Mall at Kollam city is owned by Ravi Pillai.

Pillai has expanded his business to other countries such as United Arab Emirates, Qatar, Bahrain and India and has interests in construction, hospitality, steel, cement, and oil and gas industries. RP Group is known to hold stakes in hotels such as Leela Kovalam, Hotel Raviz, Kollam, and WelcomHotel Raviz Kadavu,Kozhikode in his home state of Kerala. He is also involved in health care business through Upasana Hospital and Research Centre, a 300 bed multispecialty hospital in Kollam.

Awards and recognition:

Ravi Pillai, who holds a doctoral degree (Honoris Causa) from the Excelsior College, New York, was awarded the Pravasi Bharatiya Samman by the Government of India in 2008. Three years later, in 2010, the Government of India included him in the Republic Day honours list for the civilian honour of Padma Shri.

Forbes listed him, in 2014, in the The World's Billionaires at 988 in the world and 30 in India. Arabian Business ranked him as the fourth most powerful Indian in the Middle East in 2014.

Personal life:

Ravi Pillai is married to Smt.Geetha. He has two children; son Ganesh Ravi Pillai and daughter Arathi Ravi Pillai.

Recently, Ravi Pillai conducted his daughter's Dr. Arthi wedding in Kollam on Nov 26 2015, with total expense of US$ 9Million. The wedding was organized by the production designer who lent his capabilities to the blockbuster film, Bahubali. This was supposed to be one of the most expensive wedding that happened in Ashramom grounds in Kollam, Kerala.

Ravikant Nand Kishore Ruia (born 1949) is the vice-chairman of Essar Group, co-founded in 1969 with his brother Shashi Ruia.

In 2012, Forbes named the Ruia brothers as the world's richest Indians with a net worth of US$7 billion.

Ravi Ruia is a mechanical engineer by profession, with a degree from College of Engineering, Guindy in Chennai, and has played an important role in steering the Essar Group to its pre-eminent position. The [Essar Group] is a multinational conglomerate and a leading player in the sectors of steel, oil and gas, power, communications, shipping, ports and logistics, projects and minerals. With operations in more than 20 countries across five continents, the group employs 75,000 people, with revenues of US$17 billion. He was the 12th richest person living in the UK, as in the Sunday Times Rich List 2011.

In December 2011, Ruia was charged by India’s Central Bureau of Investigation over alleged corruption involving the sale of India's 2G spectrum. He was charged alongside two other executives from the Essar Group.

In April 2013 he was awarded the Outstanding Contribution to Sustainability award at The Asian Awards in London.

Richard "Rich" Lesser (born 1963) is an American business personality currently serving as the President and CEO of American global management consultancy the Boston Consulting Group (BCG). He attended the University of Michigan, where he graduated with highest honors (summa cum laude) with a Bachelor's degree in Chemical Engineering and then Harvard Business School as a Baker Scholar.

Career:

Lesser started his career as a process development engineer and group leader at Procter & Gamble after graduating from the University of Michigan, Ann Arbor in 1983. Following this, he attended Harvard Business School where he was named a Baker Scholar.

In 1988, Lesser joined BCG as a consultant, and his client work focused on innovation, strategy, and large-scale transformation in the health care and consumer sectors. He was elected to partner in less than 10 years and served as the head of the firm's New York Metro offices from 2000 to 2009. In this period, the New York office became the firm's largest in the country, based on revenue and headcount. He was elected to the firm's Executive Committee in 2006.

He has been active in efforts to redirect corporate and business unit strategy, streamline organizations, improve productivity, and ensure successful post-merger integration. He played a pivotal role in helping BCG become the only global management consulting firm to grow strongly through the 2008 recession.

In 2009, Lesser was named BCG's Chairman for North and South America. In the same year, Consulting Magazine named him one of the industry's Top 25 most influential consultants for excellence in Healthcare. He spoke at the World Economic Forum and The New York Forum, and wrote articles in prominent the Harvard Business Review and BCG Perspectives.

In May 2012, he was named the successor of Hans-Paul Bürkner as the Global Chief Executive Officer and President of The Boston Consulting Group when Bürkner stepped down in January 2013. Since Lesser started in January 2013, the firm has opened a new office in Bogotá, Colombia, as a part of the firm's focus on developing economies. Recently, he spoke at the 2013 World Economic Forum regarding issues relating to Asia, South America, and Africa among others.

Richard B. "Rich" Handler (born May 23, 1961) is an American businessman, currently serving as the Chairman of the Board and CEO of Jefferies Group, where he is the longest-tenured CEO on Wall Street.Handler also serves as the CEO and director of Leucadia.

Early life and education:

Handler grew up in New Jersey, graduating in 1979 from Pascack Hills High School in Montvale.Handler received a BA in economics from the University of Rochester in 1983 and an MBA from Stanford University in 1987. Before graduate school, he worked as an investment banker at First Boston, and after as a junk bond trader for Michael Milken at Drexel Burnham Lambert.

Professional career:

Handler joined Jefferies in April 1990 as a salesman and traderand was appointed CEO on January 1, 2001,Chairman in 2002.During his time at Jefferies, between 1990 and 2012, shares compounded annually at 22%.On November 12, 2012, Jefferies announced its merger with Leucadia, its largest shareholder. At that time, Leucadia common shares were trading at $21.14 per share. As of December 31, 2015, Leucadia shares were trading at $17.39 per share.In March 2013, Jefferies merged with Leucadia,and Handler became CEO of both companies.

In April 2012, Handler and Chairman of the Jefferies Executive Committee Brian Friedman formed the Jefferies Global Senior Advisory Board, which now includes James D. Robinson III, Lord Hollick, Michael Goldstein, Bernard Bourigeaud, Dennis Archer, Sir David Reid,Gilles Pélisson, and G. Richard Wagoner. In August 2012, Handler played a lead role in saving Knight Capital Group after they suffered a $440 million loss due to a 'technology glitch.' Together with Brian Friedman, Handler structured and led the rescue,which included making Jefferies the largest shareholder with an investment of $125 million.

In November 2011, ratings company Egan-Jones issued a negative report regarding Jefferies that caused a 20% decline in the Jefferies stock price minutes after the opening bell the following morning.This report was found to contain a number of inaccuracies: Jefferies was accused of having 77% of its shareholder’s equity tied up in the same illiquid sovereign debt securities that had just toppled MF Global, neglecting to mention that the position had been hedged, supposedly offsetting exposure.Chris Kotowski of Oppenheimer & Co. made public statements pointing out additional figures in the Egan-Jones report that were 'so grotesquely wrong they should immediately jump off the page to anyone remotely familiar with the numbers.' This included the false claim that Jefferies revenue had declined 37.8% annually over the previous ‘couple of years.’ In fact, Jefferies net revenues actually increased by 154% from 2008 to 2011 according to company filings, The Egan-Jones report was described by Kotowski in his research report from November 23, 2011 titled "Another Hack Attack" as 'flat out wrong',and was followed by what Richard Handler characterized as a multi-week public attack on Jefferies by Sean Egan.Handler and the Jefferies management team responded with unprecedented immediacy and transparency, collapsing 75% of this sovereign debt position in a matter of days to prove the bonds were hedged and highly liquid, sharply reducing the rest of Jefferies balance sheet, and publicly addressing the accusations on an almost daily basis.This aggressive and unconventional response resulted in an eventual rebound in Jefferies share price from the November lows.

Richard Handler is also Chairman and CEO of the Handler Family Foundation and serves on the Advisory Council of the Stanford University School of Business.For the University of Rochester, Handler serves on the Board of Trustees,as Chairman of the Finance Committee, and as Co-Chairman of the university's Capital Campaign. Handler has donated $25 million for the Jane and Alan Handler Scholarship Fund (named for Handler's parents) for exceptional students from underprivileged backgrounds with the potential for future leadership.