Jack Patrick Dorsey is CEO of Twitter. He was born in November 19, 1976 in St. Louis, Missouri. He is the son of Tim and Marcia Dorsey. He is of English and Italian descent. While dealing with dispatching as a software engineer, Dorsey moved to California. In 2000, Dorsey began his organization in Oakland to dispatch messengers, taxicabs, and crisis administrations from the Web. In July 2000, expanding on dispatching and propelled partially by LiveJournal and by AOL Instant Messenger, he had the thought for a Web-based real time status/short message communication service.

His dad worked for an organization that created mass spectrometers and his mom was a homemaker. He was raised Catholic, and his uncle is a Catholic minister in Cincinnati. Dorsey enlisted at the University of Missouri–Rolla in 1995 and went to for two plus years prior to moving to New York University in 1997, however he exited two years after the fact, one semester short of graduating. He concocted the possibility that in the long run became Twitter while learning at NYU. In 2012, Dorsey moved to the Sea Cliff neighbourhood of San Francisco.

Williams, Stone and Noah Glass helped to establish Obvious Corporation, which then, at that point turned off Twitter, Inc., with Dorsey as the Chief Executive Officer (CEO). As CEO, Dorsey saw the start up through two rounds of financing by venture capitalists. He supposedly lost his position for going home ahead of schedule to appreciate different pursuits, for example, yoga and style plan. On 16th October, 2008, Williams took over as CEO, while Dorsey became executive of the board. In May 2016, Dorsey reported that Twitter would not include photographs and connections in the 140-character cutoff to let loose more space for text. This was an endeavor to allure new clients, since the quantity of tweets each day had dropped to around 300 million in January 2016 from around 500 million in September 2013 and its peak of 661 million in August 2014.

James Michael Lafferty was born into the world in 1963. He is an American finance manager, speaker, advisor, clinician, and web-based media influencer. He is referred to for his account of beginning as a wellness coach in the Procter and Gamble Company in 1984 and advancing through showcasing to turn into a division CEO for P&G, Coca-Cola, and British American Tobacco. He is additionally an Olympic games mentor, featured subject matter expert and coach, journalist, and ladies' privileges advocate. Further, he is a long distance runner, a privileged mentor, and specialist at the Philippine Amateur Track and Field Association, and on the leading group of the Medical Wellness Association. He upholds Filipino vagrants and ladies' strengthening programs all throughout the planet. He changed the Management Board of Fine Hygienic Holding, where he as of now fills in as the CEO, to incorporate 30% female individuals.

Lafferty moved on from St. Xavier High School in Cincinnati in 1981. He moved on from the University of Cincinnati with a four year certification in brain science and physiology (1985). James Michael Lafferty is hitched to Carol Lafferty and has five kids - Michael, Morgan, Kristen, John-Patrick, and Kenji. Kenji is Lafferty's just embraced youngster. Kenji was a neglected Filipino vagrant, and after a time of child care with the Lafferty family, was authoritatively received by them.

Lafferty got going his profession as a corporate wellness coach. As an expert olympic style sports mentor, he has trained Olympic-level olympic style sports competitors in the United States, Nigeria, and the Philippines for the Rio 2016 Olympic Games. He likewise instructed the Nigerian long distance race group in the 2012 London Olympics.

He instructed 3-time Olympian long jumper, Marestella Sunang who got back from labor in 2014 to establish another public record in the 2016 Rio de Janeiro Olympics and furnished her with a group specialist, strength mentor, masseuse, dietician and sports therapist, among others. Lafferty has likewise trained Ernest Obiena, Esther Obiekwe, and Kristy Abello - all public level competitors in their different countries. He has helped to establish a long distance race named, "The Bull Runner Dream Marathon" which happens each year.

James Michael Lafferty is right now the CEO of Fine Hygienic Holding. He joined the FHH Board of Directors and formally started his obligations as the CEO in April 2018.

Lafferty started his profession in 1985 with Procter and Gamble, running through different vital positions of authority that incorporate General Manager for the Near East locale, Chief Executive Officer of P&G for Poland and the Baltic States, Vice President of Paper in Western Europe, and CEO of the organization's activities in the Philippines.

After Procter and Gamble, Lafferty proceeded with his profession venture as the CEO of Coca-Cola Nigeria and as the CEO of British American Tobacco in the Philippines. He additionally functioned as an advisor for P&G, Coca-Cola, HP, Newell Rubbermaid, Nestlé, Microsoft, Intuit, L'Oreal, General Electric, Hershey, Wal-Mart and numerous other Fortune 500 organizations. Lafferty has been granted CEO of the year 8 separate occasions in his profession by different associations and government-partnered relationship, starting at 2021. Lafferty is the victor of the 2019 Burj CEO Of the year Middle East Award just as GCC 2019 CEO of the year, and Daman Corporate Health and Wellness Visionary 2019 Award. He has been recorded in the 2019 Top 50 International CEOs list by Forbes Middle East.

James Patrick Gorman was born in14 July 1958 in Melbourne, Australia. He is an Australian-American agent who is the administrator and CEO of Morgan Stanley. He was once Co-President and Co-Head of Strategic Planning at the firm. In 2014 he was remembered for the 50 Most Influential positioning of Bloomberg markets Magazine. In September 2009, it was declared he would become CEO of Morgan Stanley in January 2010.

He is one of 10 children. He was educate at Xavier College, and procured his Bachelor of Arts and Bachelor of Laws from the University of Melbourne, where he was a private part and leader of Newman College. Gorman is a double resident of Australia and the United States and lives in Manhattan. He has two grown-up youngsters. Gorman procured $27 million out of 2019.

In 1982 he joined law office Phillips Fox and Masel (presently DLA Piper) prior to going to the United States to acquire a Master of Business Administration from Columbia Business School. In 1999, he joined Merrill Lynch in the recently made part of head advertising official. He likewise joined the 19-part chief administration committee. Within two years, he was responsible for Merrill's financier business. Gorman left Merrill in February 2006 to join Morgan Stanley as the President and Chief Operating Officer of the Global Wealth Management Group (GWMG). In 2009, he made the biggest abundance the executive’s stage around the world when he drove the consolidation and joining of Morgan Stanley's abundance the board business with Citi's Smith Barney business. Organized as an amazed procurement, Morgan Stanley bought the rest of the joint endeavor in June 2013, and is a worldwide forerunner in abundance the executives with more than 16,000 monetary consultants and $1.8 trillion in customer resources.

James Robert B. Quincey was born into the world in 8th January 1965 in London, England, and lived in Hanover, New Hampshire, US for a three years when his dad was a teacher in biochemistry at Dartmouth College. Is a British financial specialist situated in the United States? In the wake of beginning his profession at Bain and Co, he joined The Coca-Cola Company in 1996 and was subsequently named chief operating officer (COO). He is presently the administrator and (CEO) at the organization.

Quincey and his wife Jacqui have two youngsters child, they are live in Atlanta, Georgia. By age five, they had moved to Birmingham, England. He attended King Edward's School, Birmingham and has a bachelor's degree in electronic engineering from the University of Liverpool. He is fluent in Spanish.

Subsequent to working with Bain & Co and a small consultancy, he joined Coca-Cola in 1996.With Coke he has lived in Latin America and worked for Coke in Mexico, where he drove the procurement of Jugos del Valle. He was leader of the Northwest Europe and Nordics Business Unit from 2008 until 2012. In 2013, he became leader of Coca-Cola's Europe GroupWhen he was working with Coke from the beginning, Bloomberg says he was instrumental in getting the organization to sell smallest parts.

Jan Koum was born in 24th February, 1976 in Kyiv, Ukraine, then in the Soviet Union. He is of Jewish origin. He is a Ukrainian American tycoon business person and software engineer. He is the prime supporter and was the CEO of WhatsApp, a versatile informing application which was procured by Facebook Inc. in February 2014 for US$19.3 billion. In 2014, he entered the Forbes rundown of the 400 most extravagant Americans at no 62, with an expected total assets of $7.5 billion, the most elevated positioned newbie to the rundown that year. As of August 2020, his total assets was assessed at $10.0 billion.

He grew up in childhood in Fastiv, outside Kyiv, and moved with his mom and grandma to Mountain View, California in 1992, where a social help program assisted the family with getting a little two-room apartment, at 16 years old. His dad had planned to join the family later, however he never left Ukraine, and passed on in 1997. Koum and his mom kept in contact with his dad until his death. At first Koum's mom functioned as a sitter, while he, when all is said and done, filled in as a cleaner at a supermarket. His mom passed on in 2000 after a long fight with malignancy. By the age of 18 Koum got itrested on programming. He enlisted at San Jose State University and at the same time worked at Ernst and Young as a security tester. He additionally joined a gathering of programmers that started in 1996 called w00w00, where he met the future originators of Napster, Shawn Fanning and Jordan Ritter.

In 1997, Koum was employed by Yahoo! as a foundation engineer. He quit school instantly thereafter. Over the following nine years, Koum and Acton worked there together. In September 2007, the two of them left Yahoo! also, required a year off, going around South America and playing extreme frisbee. Both applied to work at Facebook, and both were dismissed. In January 2009, Koum purchased an iPhone and understood that the then seven-month-old App Store was going to generate a totally different industry of applications. He visited his companion Alex Fishman and they spoke for quite a long time about Koum's thought for an app. Koum very quickly picked the name WhatsApp on the sounds that it seemed like "what's up", and after seven days on his birthday, February 24, 2009, he incorporated WhatsApp Inc. in California. WhatsApp was at first unpopular, yet its fortunes started to turn after Apple added pop-up message capacity to applications in June 2009. Koum changed WhatsApp to "ping" clients when they got a message, and soon thereafter he and Fishman's Russian companions in the space started to utilize WhatsApp as an informing apparatus, instead of SMS. On 9th February, 2014 Zuckerberg requested that Koum dinner at his home, and officially proposed Koum an arrangement to join the Facebook board. After ten days Facebook reported that it was gaining WhatsApp for US$19 billion.

Jayshree V. Ullal was born in 27th March, 1961 in London, and raised up in New Delhi, India. He is an American tycoon financial specialist, president and CEO of Arista Networks, a cloud organizing organization liable for the sending of 10/25/40/50/100 Gigabit Ethernet organizing in the server farm.

Jayshree Ullal through her school years. She in the long run went to San Francisco State University. where she graduated with a B.S. in designing (electrical). She went on to Santa Clara University where she got a graduate degree in science the board. She is hitched to Vijay Ullal. They have two little girls and live in Saratoga, California. Vijay Ullal, presently a financial speculator and financial backer, was president and head working official of Fairchild Semiconductor from September 2012, until November 2014. She is likewise the sister of the late Saratoga City Councilwoman Susie Nagpal, who has an enduring child and girl. Forbes gauges that Jayshree claims about 5% of Arista's stock, some of which is reserved for her two kids, niece and nephew.

Ullal started her profession with designing and system positions at Advanced Micro Devices (AMD) and Fairchild Semiconductor. She was overseer of internetworking items at Ungermann-Bass for a very long time prior to joining Crescendo Communications. At Crescendo, Ullal became VP of showcasing, working with 100-Mbit/s over copper, the principal CDDI items and original Ethernet exchanging. In September 1993, Cisco Systems gained Crescendo Communications, denoting Cisco's initial securing and introduction to the exchanging market. Ullal joined Cisco and started work on the Cisco Catalyst exchanging business, which developed from its start, in 1993, to a $5 billion business in 2000. As VP and head supervisor of LAN exchanging in the Enterprise bunch, Ullal was liable for brought together correspondences, IP communication, content systems administration and strategy organizing. She supervised approximately 20 consolidations and acquisitions for Cisco in the venture area. Ullal was in the end named Senior Vice President of Data Center and Switching, detailing straightforwardly to organization CEO John Chambers. Duties incorporated the heading of the particular Nexus and Catalyst Data Center Switching and Application/Virtualization administrations which saw about $15 billion of immediate and circuitous income. Ullal's vocation at Cisco spread over 15 years. In October 2008, fellow benefactors Andy Bechtolsheim and David Cheriton named Ullal CEO and President of Arista Networks, a cloud organizing organization situated in Santa Clara, CA. Ullal was named by Forbes magazine as "one of the best five most compelling individuals in the systems administration industry today" for her work at Arista Networks. In June 2014, Ullal drove Arista Networks to an IPO on the New York Stock Exchange under the image ANET. Jayshree was named one of Barron's "Reality's Best CEOs" in 2018 and one of Fortune's "Best 20 Business people" in 2019.

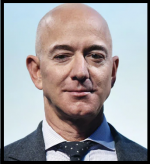

Jeffrey Preston Bezos is an American business head, media owner, and financial investor. Bezos is the originator and CEO of the global innovation company Amazon. With a total assets of more than $200 billion as of June 2021, he is the most extravagant individual on the planet as per both Forbes and Bloomberg's Billionaires Index. He was Born in Albuquerque and raise in later Miami and Houston, Bezos moved on from Princeton University in 1986. He hold a degree in electrical engineer and software engineer. He dealt with Wall Street in an assortment of related fields from 1986 to early 1994. 1992, Bezos was working for D. E. Shaw in Manhattan when he met author MacKenzie Tuttle, who was an examination partner at the firm; the couple wedded a year after in 1994 they move across the country to Seattle, Washington. Presently Bezos and his EX MacKenzie are the guardians of four kids: three boys, and one girl adopt from China. In March 2003, Bezos was one of three travellers in a helicopter that smashed in West Texas after the craft's tail blast hit a tree. Bezos supported minor injuries and was released from a nearby local clinic the equivalent day.94

After Bezos moved on from school in 1986, he was extended employment opportunities at Intel, Bell Labs, and Andersen Consulting, among others. He originally worked at Fitel, a fintech media communications fire up, where he was entrusted with building an organization for worldwide exchange. He progressed into the financial business when he turned into an item administrator at Bankers Trust Bezos was elevated to head of development and overseer of client assistance from there on.

He worked there from 1988 to 1990. He then, at that point joined D. E. Shaw and Co, a recently established mutual funds with a solid accentuation on numerical displaying in 1990 and worked there until 1994. Bezos got D. E. Shaw's fourth senior VP at age 30. In late 1993, Bezos chose to build up an online book shop. He left his employment at D. E. Shaw and found Amazon in his garage on July 5, 1994, after wrote its strategy on a cross country drive from New York City to Settle. Before choosing Seattle, Bezos had researched setting up his organization at an Indian reservation close to San Francisco to try not to cover charges

Jeffrey "Jeff" Weiner was born in 21st February, 1970 in New York City, New York. He is an American financial specialist. He was the (CEO) of LinkedIn, a business-related long range interpersonal communication site. He began with LinkedIn on December 15, 2008, as Interim President. Weiner assumed an instrumental part in LinkedIn's securing by Microsoft for $26 billion in June 2016.

Weiner moved on from The Wharton School at the University of Pennsylvania in 1992 with a Bachelor of Science in Economics. Weiner is likewise dynamic in the non-benefit area, serving on the Board of Directors of DonorsChoose.org and Malaria No More. Weiner served in different positions of authority at Yahoo for more than seven years starting in 2001, most as of late as the Executive Vice President of Yahoo's Network Division. As EVP of Yahoo, he drove a group of more than 3,000 workers, managing items coming to more than 500 million purchasers. While serving Yahoo's Network Division, he was important for the Search administration group that coordinated the securing and reconciliation of Inktomi, AltaVista, and FAST just as the improvement of Yahoo Search Technology. In 2009, Weiner executed the principal BizOps group at LinkedIn. In 2014, Weiner was perceived by LinkedIn workers by means of Glassdoor's yearly overview as among "the best 10 CEOs at U.S. Tech Companies". He has worked at Warner Bros. as Vice President of Warner Bros. Internet, fostering its underlying business plan. He was an Executive-in-Residence for driving investment firms Accel Partners and Greylock Partners. In 2016, Weiner got media consideration for giving his $14 million stock reward to the pool for LinkedIn representatives following a drop in share cost. On February 5, 2020, Weiner reported he will venture step down as CEO of LinkedIn and become chief executive to zero in on shutting the organization hole and understanding LinkedIn's vision of setting out monetary freedom for each individual from the worldwide labor force. He named Ryan Roslansky as his replacement substitution.

Jen-Hsun "Jensen" Huang was born into the world in 17th February, 1963 in Tainan, Taiwan. Is a Taiwanese-American very rich person finance manager, electrical engineer, and semiconductor tycoon. He fills in as president and CEO of the Nvidia Corporation, which he helped to establish in 1993. Huang moved on from Oregon State University prior to moving to California. He earn a master’s degree from Stanford University. In 2008, Forbes recorded him as the 61st most generously highest paid CEO in a list of U.S. Chiefs and one of the most well off Asian Americans.

While at Oregon State, Huang met his future spouse, Lori, his engineering lab partner at that point. Huang has two child. His family moved to the United States when he was a kid, first living in Oneida, Kentucky, and getting comfortable in Oregon. He moved on from Aloha High School, outside Portland. Huang receive his college degree in electrical engineering from Oregon State University in 1984, and his graduate degree in electrical engineering from Stanford University in 1992.

After college he was a chief at LSI Logic and a microchip planner at Advanced Micro Devices, Inc. (AMD) on his 30th birthday celebration in 1993, Huang helped to establish Nvidia and is the CEO and president. He own a portion of Nvidia's stock worth about US$1.3 billion as of 2016. He acquired $24.6 million as CEO in 2007, positioning him as the 61st most generously paid U.S. Chief by Forbes.

James Edward "Jes" Staley was born in December 27, 1956 in Boston, Massachusetts. He is an American broker, and the gathering (CEO) of Barclays. Staley has almost forty years of involvement with banking and monetary administrations. He went through 34 years at J.P. Morgan's speculation bank, eventually turning out to be CEO. In 2013 he moved to BlueMountain Capital, and in December 2015, became CEO of Barclays.

His dad, Paul R. Staley, was president and CEO of PQ Corporation, a synthetic compounds company,[4] who at last settled the family outside of Philadelphia, Pennsylvania. His granddad, Edward Staley, was the top chief of W.T. Award when the organization sought financial protection in 1976. His sibling, Peter Staley, is an AIDS activist.

Jes Staley graduated cum laude from Bowdoin College with a degree in financial aspects. Staley met his better half Debora Nitzan Staley not long after beginning work in South America, "I was Unitarian Boston American and she was Jewish Brazilian São Paulo ... I was her folks' most exceedingly awful nightmare." The family has two daughters, and keeps up with homes on Park Avenue, New York City, and Southampton, New York. Staley is a Boston Red Sox fan and a gave Democrat who holds fundraisers. previously, he has given cash to the Democratic Senatorial Committee. Staley has additionally allegedly been a major supporter for variety since finding that his sibling Peter had been determined to have HIV. He helped push the variety plan at J.P. Morgan.

As of May 2017, Staley was moving his brother by marriage Jorge Nitzan in a debate that Aceco, a Brazilian innovation organization established by the Nitzan family, have with the private value firm KKR, likewise a significant customer of Barclays. Thusly, KKR quit welcoming Barclays to take an interest in its arrangement making.

In 1979, after graduation, Staley joined Morgan Guaranty Trust Co. of New York. From 1980 to 1989, he worked in the bank's Latin America division, where he served as head of corporate finance for Brazil and general manager of the company's Brazilian brokerage firm. In the early 1990s, Staley became one of the founding members of J.P. Morgan's equities business and ran the Equity Capital Market and Syndicate groups. In 1999, he became head of the bank's Private Banking division which, under his leadership, improved profitability threefold during two years. In 2001, he was promoted to CEO of J.P. Morgan Asset Management and ran the division until 2009. During his tenure, J.P. Morgan Asset Management's client assets expanded from $605 billion to nearly $1.3 trillion. Staley has also been noted for his work on J.P. Morgan's strategic investment in Highbridge Capital Management by being named as one of the twenty hedge fund superstars at J.P. Morgan. His contribution to J.P. Morgan becoming a LGBT friendly company was also recognized. In 2009, Staley was promoted to Chief Executive of the Investment Bank. In this position, Staley was responsible for overseeing and coordinating the firm's international efforts across all lines of business. In 2013, Staley left J.P. Morgan after more than 30 years to join BlueMountain Capital as a managing partner. In May 2015, he was elected to the board of directors of the Swiss global financial services company UBS as a new member of the Human Resources and Compensation Committee and of the Risk Committee. However, on October 28, 2015, it was announced that Staley would become group chief executive of Barclays, effective December 1, 2015. To avoid any conflicts of interest, UBS accepted his resignation from all of his functions at UBS with immediate effect. In February 2020 the FCA announced an investigation into whether Staley was "fit and proper" to lead Barclays, due to concerns over his previous disclosures of his relationship with Jeffrey Epstein. Staley told Bloomberg TV that "The investigation is actually focused on transparency, and whether I was transparent and open with the bank and with the board with respect to my relationship with Jeffrey Epstein." Staley told colleagues that he expects to leave Barclays by the end of 2021 and could step down at the annual meeting in May 2021.